The ripple effects of EU climate policy

As the European Union intensifies its efforts to meet its 2050 net-zero commitment, the maritime sector is undergoing a significant transformation. The introduction of the EU ETS and the FuelEU Maritime regulation marks a turning point, reshaping how emissions are managed, shared, and monetised across the industry. Alongside these, new measures adopted at IMO MEPC 83 introduce further global requirements for emissions reduction, reinforcing the shift toward a more regulated and strategically complex future.

Understanding the new regulations

FuelEU is a key part of the EU’s Fit for 55 package, targeting a progressive reduction in shipping’s greenhouse gas (GHG) emissions. The regulation sets out well-to-wake carbon intensity targets that begin with a 2% reduction in 2025, increasing to 80% by 2050. These targets span the entire fuel lifecycle from production to onboard use.

Beyond technical mandates, FuelEU introduces a strategic and commercial dimension to decarbonisation efforts. Compliance now directly informs risk management practices, with significant implications for contractual structuring, investment decisions, and fleet-wide financial planning.

In parallel, the IMO’s MEPC 83 meeting introduced further measures targeting global GHG reductions, including new mid-term carbon pricing mechanisms and enhanced fuel standards. These developments mean that stakeholders must now prepare for increasingly complex compliance obligations not only within Europe but globally. Staying ahead will require early adoption of digital tools, improved voyage modelling, and robust fuel and emissions strategies.

The regulation compels stakeholders to reassess how they model voyage scenarios, simulate alternative fuel options, and manage pooling strategies to mitigate risk and reduce exposure. Effective use of digital tools enables organisations to turn regulatory complexity into a source of competitive advantage by reducing exposure, achieving a surplus through smarter fuel choices, and making more informed decisions about how to structure operations and charter agreements.

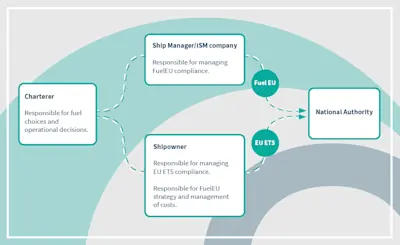

The diagram below shows how regulatory responsibilities are distributed among key stakeholders under FuelEU and EU ETS.

Ship managers: taking the lead on compliance

For vessels over 5,000 GT entering EU ports, the primary burden of FuelEU compliance falls on Document of Compliance (DoC) holders under the ISM Code. Quite often this is the ship manager, responsible for monitoring and reducing well-to-wake carbon intensity across fleets, ensuring operational performance aligns with regulatory thresholds. This includes tracking real-time fuel consumption and emissions data with accuracy and consistency.

While ship managers provide the data and technical oversight required for FuelEU compliance, strategic decisions around pooling, banking, and borrowing of emissions balances generally fall under the remit of shipowners. These mechanisms allow compliance balances to be redistributed across fleets to mitigate deficits, adding further complexity.

In addition to FuelEU, DoC holders are increasingly expected to support emissions tracking and reporting under global frameworks like MEPC 83, further reinforcing their central role in emissions management.

However, the broader fleet compliance strategy is often determined by the shipowner or operator. This division of responsibility can lead to scenarios where ship managers are held accountable for compliance outcomes despite limited control over key variables. As a result, close coordination and shared digital infrastructure among stakeholders are essential.

With non-compliance penalties potentially reaching millions annually, the need for precise data, cross-functional alignment, and robust digital tools has never been greater.

Charterers: increasing accountability and collaboration

Charterers now play a pivotal role in FuelEU compliance, given their control over fuel procurement and voyage planning. They must incorporate carbon intensity into voyage cost calculations and engage in energy efficiency agreements with ship owners.

Examples of such agreements include:

- Slow steaming agreements to reduce fuel consumption

- Operational optimisation initiatives (e.g., better weather routing, just-in-time arrivals)

Evolving charter party clauses are also beginning to mandate the use of more efficient or expensive fuels to achieve a FuelEU surplus. These clauses can shift the cost burden and create mechanisms for compensation between charterers and shipowners, changing the traditional commercial dynamics of the chartering relationship.

Time charterers are particularly impacted, as they typically procure the fuel and may be held accountable for associated emissions liabilities. The commercial implications are considerable: vessels with lower emissions profiles will become more attractive, while non-compliant ships may face reduced chartering opportunities or financial penalties.

Shipowners: navigating complexity with long-term strategy

Under FuelEU Maritime, shipowners play a critical strategic role in managing compliance—especially when they also hold the Document of Compliance (DoC) under the ISM Code. Even when not the DoC holder, shipowners often oversee fuel strategy, pooling decisions, and commercial planning. Their responsibilities include:

- Evaluating the complexity and viability of alternative fuels to determine which are most beneficial for FuelEU compliance. These include LNG, ammonia, methanol and advanced biofuels.

- Making capital investment decisions for retrofitting or deploying new technologies (e.g., carbon capture, hybrid systems, wind-assisted propulsion).

- Managing financial risk by overseeing pooling, banking, and borrowing strategies to offset emissions across the fleet or in collaboration with third parties.

- Coordinating across all stakeholders: operators, managers, and charterers—to ensure compliance is met without undermining commercial performance.

They must also ensure emissions data is verified and submitted via the EU MRV system, typically in partnership with an accredited third-party verifier such as Lloyd’s Register’s Emissions Verifier.

Managing multi-regulatory compliance

In addition to FuelEU, shipowners are responsible for EU ETS compliance, requiring careful tracking of EUA exposure, trading strategies, and surrender obligations. The UK ETS scheme adds a further regional dimension, meaning shipowners must manage compliance across multiple carbon markets.

Moreover, shipowners need a long-term vision. Regulations like FuelEU, EU ETS, and the new IMO regulations introduced at MEPC 83 are only the beginning—emissions thresholds will tighten further over time. Strategic fleet planning must reflect this trajectory.

With multiple frameworks in play, shipowners must take a long-term view. Those who invest early in digital tools, flexible fleet strategies, and collaborative partnerships will be better equipped to navigate the tightening regulatory environment and maintain operational agility.

Shifting dynamics across the maritime industry

FuelEU, EU ETS, UK ETS, IMO MEPC 83 and other emerging regulations are reshaping stakeholder responsibilities and commercial relationships across the maritime sector. Regulatory compliance is no longer a short-term project; it is a permanent feature of shipping operations.

How OneOcean Risk Manager supports stakeholders

Risk Manager enables shipowners, managers, and charterers to manage emissions exposure across a range of regulatory schemes—FuelEU, EU ETS, and beyond—through one connected solution.

Risk Manager leverages our extensive global experience in vessel routing backed by the industry’s best vessel models, weather forecasts, and route optimisation engine to help you accurately manage your FuelEU and EUA exposure in a single, easy-to-use platform.

You’ll gain the insights to optimise compliance strategies, track performance, manage costs and stay connected with other stakeholders at every stage of a voyage.

From pressure to opportunity

Compliance is no longer optional; it’s a competitive advantage. With Risk Manager you can take control of emissions exposure and confidently build an emissions compliance strategy all in one platform.

FuelEU, EU ETS, and other evolving regulations signal a paradigm shift in how the industry approaches compliance, cost control, and collaboration. By leveraging intelligent insights through Risk Manager, maritime stakeholders can turn regulatory pressure into strategic opportunity — mitigating the risk of financial penalties and thereby supporting profitability, while ensuring resilience and advancing sustainability in a changing industry.

We are committed to continuously evolving Risk Manager to meet your needs and support your compliance strategy, guided by insights from our trusted LR Regulatory Affairs team, as regulations develop.